As an organisation’s initiatives multiply, the need for a streamlined and standardized method to identify, select, monitor, control, and report on results becomes essential. Portfolio Management offers a solution, enabling organisations to optimise investments by curating portfolios that align with their overall strategy, considering resource capacity, capabilities, and budgetary constraints.

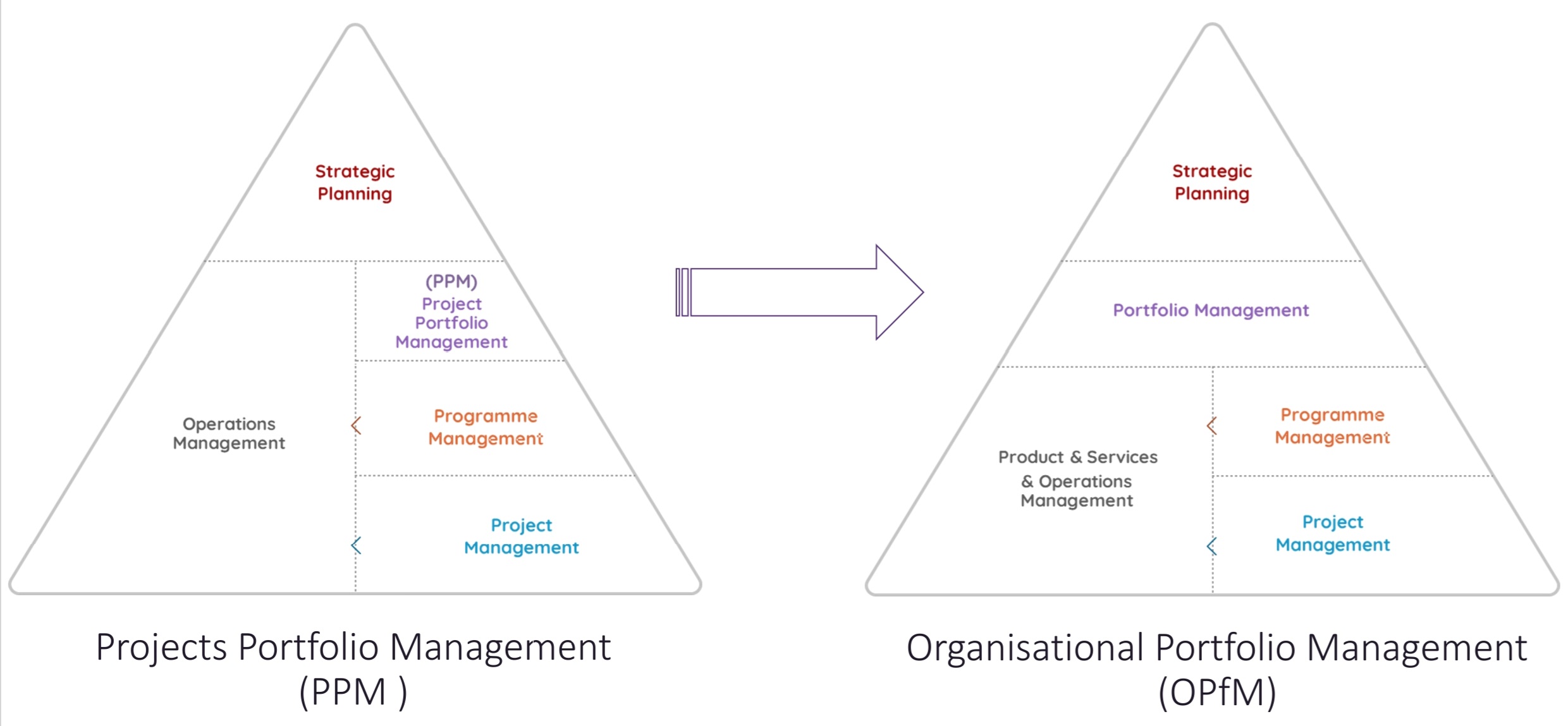

However, the traditional approach of Project Portfolio Management (PPM) falls short in capturing the true essence of organisational investments. Projects, although crucial, merely account for the expenditure of creating an organisational asset without adequately focusing on value creation through the utilization of project outcomes. Furthermore, it usually neglects to consider the Total Cost of Ownership (TCO) associated with the asset, be it a product or service.

Read an article about the origins and limitations of PPM here.

Limiting an organisations portfolio solely to project-based value creation activities is a weakness when organisations have diversified investments. As organisations grow and evolve, they may engage in various investment types beyond traditional projects, such as building and offering to clients products and services. Focusing solely on projects overlooks other essential areas of value creation.

The processes and practices of Project Portfolio Management are not obsolete, however, PPM needs to evolve to meet current portfolio needs of organisations.

This realisation has led to the implementation of Organisational Portfolio Management (OPfM), a more comprehensive, holistic, and forward-thinking approach that encapsulates a broader spectrum of organisational investments. OPfM encompasses projects, programmes, products, services, and operational assets, following them from inception to replacement or retirement.

Positioned between strategic planning and the project and operational management layers, organisational portfolios enable organisations to view and manage financial and human resource investments comprehensively, and achieve the monitoring and controlling and reporting of the portfolio performance and benefits realisation.

Embracing Organisational Portfolio Management is the way forward for organisations seeking a more holistic, strategic, and efficient approach to manage their initiatives, achieve their goals, and foster sustainable success.

The origins of PPM stem from the need to manage multiple client projects effectively in projectised organisations, where projects are the primary means of value creation.

However, this is scenario does not reflect the needs of all organisations as focusing solely on projects overlooks other areas of value creation.

Many organisations run projects with the view of creating new products and services, which often become their primary means of value creation.

About Organisational Portfolio Management (OPfM)

The result is an aggregated and all-encompassing view of ongoing and planned initiatives, ultimately leading to the effective accomplishment of strategic objectives.

In the context of an Organisational Portfolio

a Project Portfolio is nothing more than a limited view

of the overall organisational portfolio that includes only investments of type project/programme.

OPfM addresses this weakness of PPM by including in the portfolio the outputs of projects, tracking their value creation while considering the effort and costs of exploiting the project results. An organisational portfolio consists of its different type of components, collectively contributing to the achievement of specific strategic value-creation objectives.

While each portfolio component is managed individually with distinct management structures and methods, portfolio management adds an extra management layer of strategic, financial, and value creation focus to the entire portfolio. Furthermore, OPfM facilitates effective collaboration between various component management layers (i.e. project, services, product, operations management layers), ensuring that their efforts are complementary and synergistic and their management approaches aligned.

OPfM results a more integrated and collaborative decision-making process by managing the entire organisational portfolio cohesively.

By broadening the type of investments included in a portfolio and providing holistic performance insights of the value creation of its components, OPfM presents a more robust and effective approach to managing organisational initiatives.

The implementation of an organisational portfolio may vary depending on an organisation’s structure, maturity, and specific needs. Some portfolios may be given a strong mandate to achieve strategic objectives with their own dedicated budgets, while others are created reactively to consolidate existing investments for reporting purposes. An organisational portfolio’s flexibility can accommodate a broad spectrum of scenarios, striking a balance between strategic focus and financial efficiency.

Learn more about PfM² which is a Methodology for Organisational Portfolio Management here.

Conclusions

Project Portfolio Management has served as a valuable tool in the past, but as organisations face increasingly complex and diverse investments, the limitations of PPM have become evident. The rise of Organisational Portfolio Management (OPfM) represents a paradigm shift towards a more encompassing, strategic, and efficient approach.

As each organisation is unique, OPfM offers the flexibility to adapt to various structures, maturities, and specific needs. Whether portfolios are established to achieve specific strategic objectives or to consolidate existing investments, OPfM provides the framework to accommodate a wide range of scenarios.

At the heart of OPfM lies the deep connection between strategic objectives and investments, forming a pyramid that connects strategic planning, portfolio management, project and programme delivery, and operational activities. This holistic approach ensures that financial and human resources are utilized optimally, and benefits realization is a continual focus.