Advancing on an evolution journey towards higher levels of portfolio management performance involves being able to define as-is and to-be states of performance and implementing continual improvements of the organisation’s capability and capacity in portfolio management.

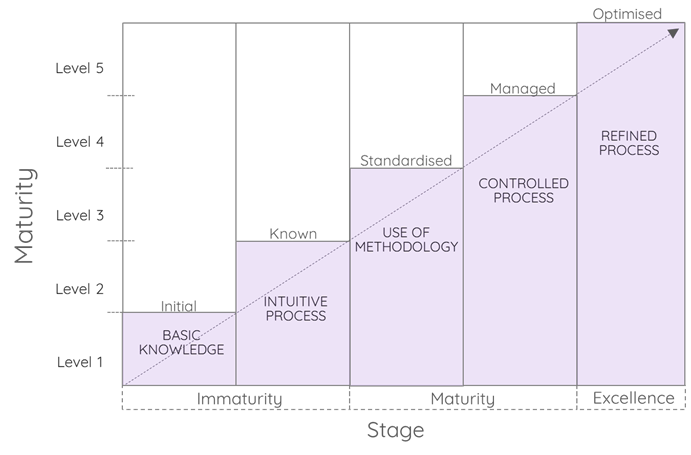

Maturity Models provide a map consisting of a sequence of maturity levels, which show a typical evolution path represented in discrete stages of organisational performance in a specific management domain. As such, they become important instruments which organisations can use to assess themselves, identify gaps towards their desired state of portfolio management effectiveness (i.e. maturity) and plan for their improvement.

The lower levels of maturity stand for states that characterize organisations having initially low capability in the domain. In contrast, the higher levels represent a state of higher maturity and excellence in the domain.

Maturity Models provide a map for organisations which can be used to design a path towards the desired state of portfolio management effectiveness (i.e. maturity).

In the lower levels, the visible cost of portfolio management is seemingly low, but the hidden opportunity costs and risks associated with ad hoc and uncontrolled approaches are notably high. In contrast, in higher levels of maturity, the cost of portfolio management is seemingly higher, but the opportunity cost and aggregated inefficiency cost, and risk are low, making the investment in reaching the higher levels of portfolio management maturity a smart and well worth investment.

In the lower levels, the visible cost of portfolio management is seemingly low, but the hidden opportunity costs and risks associated with ad hoc and uncontrolled approaches are notably high. In contrast, in higher levels of maturity, the cost of portfolio management is seemingly higher, but the opportunity cost and aggregated inefficiency cost, and risk are low, making the investment in reaching the higher levels of portfolio management maturity a smart and well worth investment.

Maturity assessments can be conducted by organisations to determine their maturity level and further identify the criteria and characteristics they need to fulfil in order to reach a new desired level of maturity associated with an improved level of performance in Portfolio Management. Assessments can be conducted both before embarking on a journey to implement Portfolio Management and afterwards feeding the continual improvement cycle.

Low levels of portfolio management maturity are characterised by low awareness and only basic knowledge of the concepts of portfolio management, and no clear appreciation of its value. Any efforts in establishing a portfolio are based on ad hoc efforts usually aiming at simply creating an inventory of ongoing organisational initiatives. But the results are often partial and of low quality and value. Due to the lack of a process, the portfolio activities are often one-off, the portfolios are not maintained, and they very quickly become out of date and irrelevant (or damaging) to management decisions as they can provide a partial (or false) representation of reality. This state is often reinforced by management deficiency and lack of management accountability towards poor organisational performance.

As some portfolio management domain knowledge is developed, simple portfolio management processes may be followed, but they are usually introduced and applied as the result of the initiative of individuals with some prior experience in the domain. However, the processes followed are intuitive and not clearly defined, neither are they repeatable, measurable, or common within the organisation. The quality of portfolio management is varied, and depends greatly on the efforts, interest and expertise of the people involved. Furthermore, the portfolio composition is simplistic, without adequate and objective criteria for evaluation, selection, prioritisation, and capacity planning. Finally, there is no clear definition and allocation of roles, responsibilities, and accountabilities, namely who does what and who is accountable for the results (i.e. success or failure).

The intermediate levels of maturity are characterised by good knowledge of portfolio management within the organisation, and a clear portfolio orientation. Standardised portfolio management processes are available for use organisation-wide, which is the result of an investment towards defining a portfolio management approach. A portfolio culture becomes gradually embedded within the organisation, with the buy-in and the involvement of both senior management, programme, projects practitioners as well as service, products, and operations management, while the management processes used in these domains are beginning to be aligned with one another. However, while the accountability of the management of portfolios and their results are recognised and clearly assigned, there are no defined metrics to assess the performance of the portfolio management process itself, and therefore no managed continual improvement goals or possibility exists.

At the higher levels of maturity, organisation-wide portfolio management is achieved to a considerable extent, while the results of portfolios (and their components) influence many management processes and decisions within the organisation. A portfolio culture is well established in the organisation and driven by all management levels, while the portfolio, the programme, project, service, product development and operational lifecycles are well integrated. In addition, effective performance KPIs are set to measure the quality of the various portfolio management processes as well as their results. At this level, the portfolio management process is now considered to be managed.

Based on the analysis of the performance data collected from portfolio systems and stakeholders, process improvement actions can be devised, and their execution formally and systematically planned and controlled. Improvement becomes primarily process and data driven and decreasingly dependent on the initiatives and ideas of the people involved. This is part of the continual improvement process which assures the increased quality and effectiveness of the portfolio management process and its outputs. The result is a high performance and holistic portfolio management approach, with aligned systems, tools, and experts collaborating across organisational departments and disciplines. At this highest level of maturity, portfolio management is optimised to the needs of the organisation and its artefacts and outputs provide adequate assurance that the organisation’s portfolio management is fulfilling its purpose.